Last week I received an email from a reader. It read, “I was preparing my application for a Portugal resident visa, and upon meeting with a tax lawyer, I was advised that my SS pension will be taxable; based on my current income (SS pension plus IRA distributions), my tax rate would be around 43% in Portugal. I think that is too steep for me so I decided not to proceed with my resident visa.”

A Bit of Context

In 2009, Portugal introduced the NHR program. Its goal was to attract foreigners to Portugal by exempting them from income taxes on "foreign income” for 10 years. The program was very successful … perhaps too successful. So on 1 April 2020, NHR was revised. For those immigrating after 30 March 2020, 10% would be charged on pension income.1 Denise and I landed in Portugal on 31 December 2020 … we are under the revised program.

Before 2024, all of our income was not taxed under NHR.2 We would file our US tax return and then send the data off to our Portuguese tax preparer. However, in 2024, Denise and I turned 70 and began receiving Social Security payments. As such, this year, we filed for an extension in the States and must wait to receive our Portuguese tax statement from our accountant.

A Few Things to Know

If you are a retired American living in Portugal, there are a few things you need to know:

If you live abroad, the IRS grants an automatic extension until June 16, 2025, to file your return.3

However, any taxes owed are still due by April 15, 2025, with interest accruing on unpaid balances. Payments made after June 16 incur both interest and failure-to-pay penalties.

If you pay foreign taxes to Portugal and are subject to U.S. tax on the same income, you may be able to take a credit or deduction for these taxes. Our tax treaties say you will not be taxed twice on the same dollar.

In addition, you must file FBAR if you maintain a Portuguese (any non-US) bank account.

Taxes for Newcomers

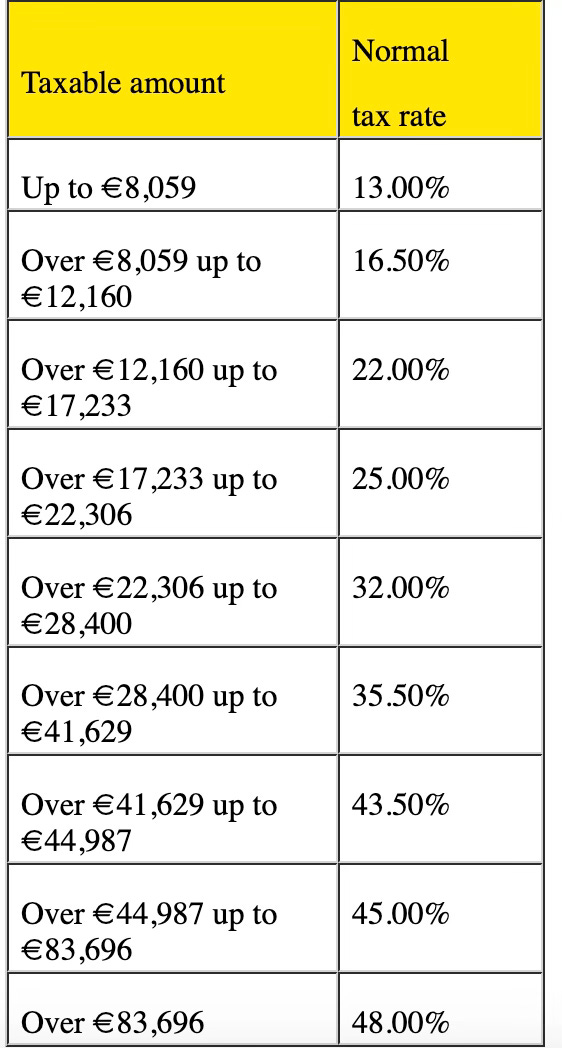

Between 1964 and 1987, the highest tax rate paid by individual Americans was cut nearly in half … from 70% to 38.5%. Today, the top US rate is 37% and is only paid on individual income above $626,351. So, when an American looks at the Portuguese tax table, they experience sticker shock.

However, it is not as simple as finding your total income on the chart above. Like the US system, the tax is progressive (the first €8059 is taxed at 13%, etc). In addition, investment income is taxed at a different rate (28%), and you will likely be eligible to take Portuguese deductions and credits. We asked our Portuguese tax preparers to estimate our taxes after NHR, it was about 37%. Of course, each case is different. I also hasten to add that while I prepared our US taxes for many years using TurboTax I would not even consider preparing our taxes for Portugal.

Is Anybody Home?

I chatted with a TurboTax representative last night. I wondered if anybody would know if I didn’t file US taxes this year.

More to the point, I am glad that my tax bill in the US will be reduced by the amount we pay in Portugal this year. It only seems right!

Important Disclaimer: I am not now, nor have I ever been a tax preparer in the US or Portugal. Please seek the advice and assistance of a qualified professional.

Tchau, fica bem …

Nanc

A Trash Update: I am writing this post on Friday, 11 April. Today at 16:00 we have a meeting with the city’s Senior Engineer responsible for the placement of the new trash system. He has received a dozen or more emails from me over the past few weeks. I have documented the multiple locations near our home where I can already take trash. (They don’t seem to be replacing any of these.) I have documented a place one block away that does not have any homes or churches where the “new” units could be installed. I have sent him photos of the front of our house every time it rains. Several of my neighbors are going with me. They expect he will explain the “project” the city has approved. They don’t expect him to agree to any change to the project.

Then on Thursday at 09:00 we are accompanying the priest when he addresses the President and the Assembly. After several failed attempts to hire an attorney, we were told our best bet was the priest. The Catholic church, they suggested, has more pull than a lawyer in a case like this. Stay tuned…

Portugal's NHR 2.0, officially known as the Tax Incentive for Scientific Research and Innovation (IFICI), took effect on January 1, 2024. It replaced the previous Non-Habitual Resident (NHR) tax regime. As such, those immigrating now are not eligible for the NHR program.

Denise receives a military pension that is not taxed in Portugal … and our dividends and withdrawals from retirement/investment accounts were not taxed. We did have a bit of a scare at one point…but it all worked out.

We may not receive our tax bill until after this date … so we filed for an extension until October. However, taxes are still due by April 15, 2025.

People are amazing. They want the many benefits of living in a EU country with peace, security,

food and drug safety, and many social programs, but they don’t want to pay the taxes. You get what you pay for. I had neighbors who spent hundreds of dollars on Halloween decorations, but complained constantly about income taxes and “the welfare state”. If you value peace and security, invest in it.

Thank you for sharing. Learning the real facts are so important. Good luck with your trash. Your description on scrubbing your house reminded me of stories of my grandmother. She lived the last 3rd of her life in a white frame house down the street from a Paper Mill in the mountains of NC. The black smoke pouring out dirtied her home and she would clean it daily. I think the exercise of cleaning kept her healthy since she lived to be 100.