Last week we left Onix with the dog sitter and headed south for five days. While we enjoyed some golf, the main purpose of our trip related to where we might live in the future. The first decision many expats face is rent or buy.

Renting

Of course, either decision has both pros and cons. Among the pros of renting are:

Dealing with Uncertainty: We have met a couple that has spent the last month traveling throughout Portugal…frankly they have seen more of the country in the last month than we have in the last 10 months. They are now spending two additional weeks in Portugal…one week in each city that they think they might like to live in. Their hope is to return to the U.S. in two weeks, to begin the D7 process, having decided which city they will want to land in. But even having done that research they will rent when they arrive. You really don’t “know” a city when you are vacationing.

Living vs Vacationing: I suspect our friends Mike and Mary agree with my comment above. They landed in Porto about four months ago. When their current lease ends they will pick up and move to a different part of the country. It is not that they dislike Porto, rather they made a very conscious decision to live in multiple cities/villages over the next few years until their inner self says “stop”.

Less Responsibility: But, why stop? Many of our older expat friends, like us, have not rented in 30+ years. Many have sold homes with too many rooms and too much land for the two of them. They are now enjoying the fact that they have fewer responsibilities. If something needs fixing, they call their landlord rather than a tradesman they may have difficulty communicating with.

Maybe 5 Years: We have another friend that has been feverishly looking for an apartment to buy. I have tried to help by pointing out a new listing I pass on a walk or accompanying her on a showing. Frankly, I was a bit taken aback the other day when she mentioned she might move to another country in five years. “Then why are you buying?” I exclaimed (perhaps a bit too forcefully.) We came to Portugal thinking we would rent. We came to Portugal thinking we would return to the States in five years. We wanted flexibility, and the lesser responsibility renting afforded. It was not until we decided that Portugal was our “forever home” that we thought about buying.

According to the Portuguese National Statistics Institute (INE), rental prices will rise by 0.43% in 2022 according to inflation figures for the last 12 months until the end of summer 2021. This increase in rental prices in Portugal in 2022 may or may not be applied by landlords, and applies to both residential and commercial rentals in urban and rural areas. — Idealista

Of course, we all grew up thinking purchasing our homes was an investment. It was a hedge against inflation. I know it was when my parents bought a house in 1957 and lived in it until 1990. Over the later years of the mortgage their real estate taxes were more than the monthly mortgage payment. After 30 years, they had a mortgage-burning party. There was a sense of freedom associated with not having a mortgage! They were able to sell the house for a LOT more than they bought it for, and bought their next home for cash.

Before You Buy, Consider

If you have sold a home in the U.S. in the past year you likely had an experience like ours. First, you were pleasantly surprised when the realtor gave you a suggested list price for your home. Second, you were shocked when s/he told you to take a vacation or move out for a few days because the expected number of showings would be disruptive. Third, you smiled when you received multiple offers within a few days. Finally, you opened a bottle of champagne when you got to choose between multiple offers above the list price. Having come off of such an experience you may think selling your home, at a profit, is easy. Real estate is an investment right?

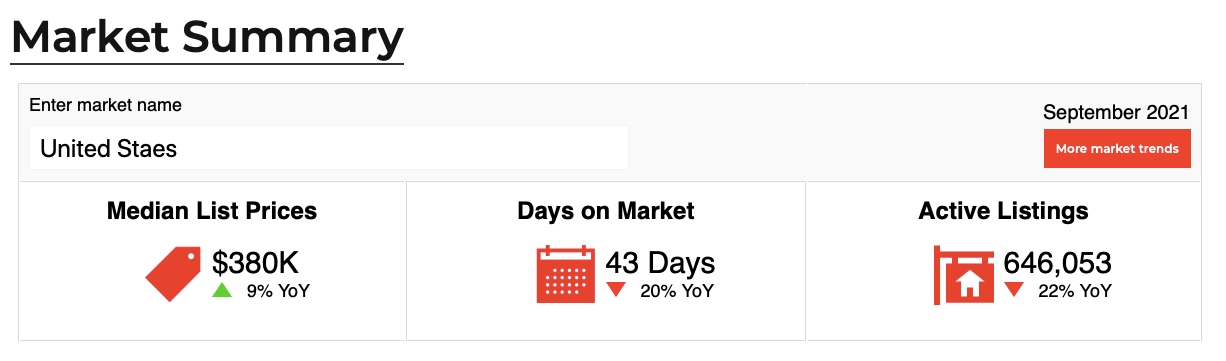

Not always, remember 2008? And one should not assume that selling a house in the U.S. is the same as in Portugal. I “Googled” days on market and found you can actually find this information online by zip code in the States. In addition, there are online reports in the States showing the average sell price, the number of properties for sale, etc. I tried to find such data for Portugal…and found a report published in December 2020:

In Portugal, the average period for selling houses is currently around 5 months, having increased compared to the third quarter of 2019 when Portugal was experiencing a period of economic growth and of course, without COVID-19. —Idealista.pt

I also consulted my favorite realtor, Elizabeth, and she estimated a bit longer (6 months) based on her experience in the greater Lisbon metropolitan area. My point is, it takes longer here! So if you decide Portugal (or a particular town in Portugal) is not for you it will take longer to sell.

Crystal Ball

No one has a crystal ball. Especially me. We have purchased 10 houses (to live in plus investment properties) over the years. I realize for many folks this is a lot of homes…we should be experts. NOT! While we always made money on our investment properties, we were not so lucky with our own homes. We have lost money, made money, and broken even. I don’t own a crystal ball and am not convinced anyone else has one either. But here are a few things to consider. Compared to other European countries, housing prices in much of Portugal are very reasonable. And over the past few years, they have seen significant gains. At the same time, there are several factors that may moderate these prices moving forward:

Changes to Golden Visa: While real estate prices have increased throughout Portugal, the most spectacular gains have been seen along the coast. Frankly, most coastal real estate is now out of reach of the typical Portuguese citizen. It is reasonable to surmise that this was an unintended consequence of the Golden Visa program. Purchases in the major cities such as Lisbon or Porto or in coastal towns of the mainland will no longer qualify for a Golden Visa after 2021. Many believe that houses that should have been priced at €400,000 crept up to €500,000 to qualify, and will moderate over the next year.

Rent/Mortgage Moratorium: Like the U.S. many qualified for a rent or mortgage moratorium in Portugal due to Covid. The moratorium ends this month. While the published unemployment rate in Portugal sits at 6.4% (August 2021) many believe it is a bit higher. Add to this that the current CPI is 1.5% (with housing representing -0.1% of this index)…one might reasonably assume the real estate market will remain flat or decline slightly.

You Would Think

Given the above, you would reasonably conclude that we are planning to continue to rent. Please don’t assume we are rational human beings. For a variety of reasons that we will disclose in the future, we plan to buy. In fact, we are in the midst of it now.

But if you are a rational human being you may want to take a bit of time making this decision. Moving to Portugal represents a whole new life for you…one that may be very different than the way you lived life in your home country.

Oh my goodness, I have just stumbled upon your blog. I could spend days or weeks here! Thank you for these thoughtful posts. I am still in research mode, deciding on whether or not to make the move to Portugal, and your blog is so informative! Thank you so much! I've got to stop for today, even though I don't want to! But I'll be back.

Hi Nancy. This was another great post. You're correct - Mary and I do agree with you about living somewhere for a while before putting down roots. We're looking forward to experiencing life in Lisbon, Cascais, and probably several other places before doing anything "permanent". And your description of selling a home in the US recently is spot on. It mirrored our experience right down to popping the champagne. But even though we sold above asking price, we only broke even because we'd put too much money into a big remodeling project. (Some people pour money into cars or boats. We put ours in the house.) We've never made a profit on a home sale, but usually broke even, so I've stopped thinking about owning a home as an investment. Perhaps, like Scott, we could use it as a hedge against currency fluctuations, but we're still undecided about whether we'll ever buy again. Thanks for providing some insight into the Portuguese property market.