If you know me or have been reading our adventures for any length of time, you know that I am pretty fastidious about money. But there were some things I didn’t fully understand before we moved overseas.

Before We Moved

The month before we moved I was talking to every U.S.-based financial institution we had any relationship with. While we already had digital statements and automated payment, I just wanted to make sure there were no surprises. One of my concerns was the 2-step verification process required for many online activities related to finances. For example, when Vanguard didn’t recognize an IP address they might send me a verification code for entry before allowing me to access my account. For the institutions that could not accept a foreign phone number, I had to approve a verification waiver.

We reviewed our credit cards and decided which to keep. While we had read that canceling credit cards might impact your FICO score … we really weren’t that concerned. We don’t borrow money, and there was no benefit to keeping any card that charged overseas transaction fees or utilized a less advantageous foreign exchange rate. I called Capital One, a card we intended to keep, and was assured living overseas would not be an issue.

Oops

So imagine my surprise the first time I attempted to make an online purchase with my Capital One credit card. The payment clearing house Rad utilizes for online purchases attempted 2-step verification via text. Without an option to enter a Portuguese phone number that wasn’t going to work. No problem, I’ll use Apple Pay … nope. As luck would have it, Denise’s Navy Federal Credit Union card worked for her bike. But when I attempted to use it a second time to order my bike, it failed. (I suspect the algorithm intended to stop multiple fraudulent charges caused the denial.)

My MEO phone plan allows international calls after 2100 hours (9 pm) so I called Capital One later that night. After a frustrating conversation, it was determined nothing could be done.

Multibanco Advantages

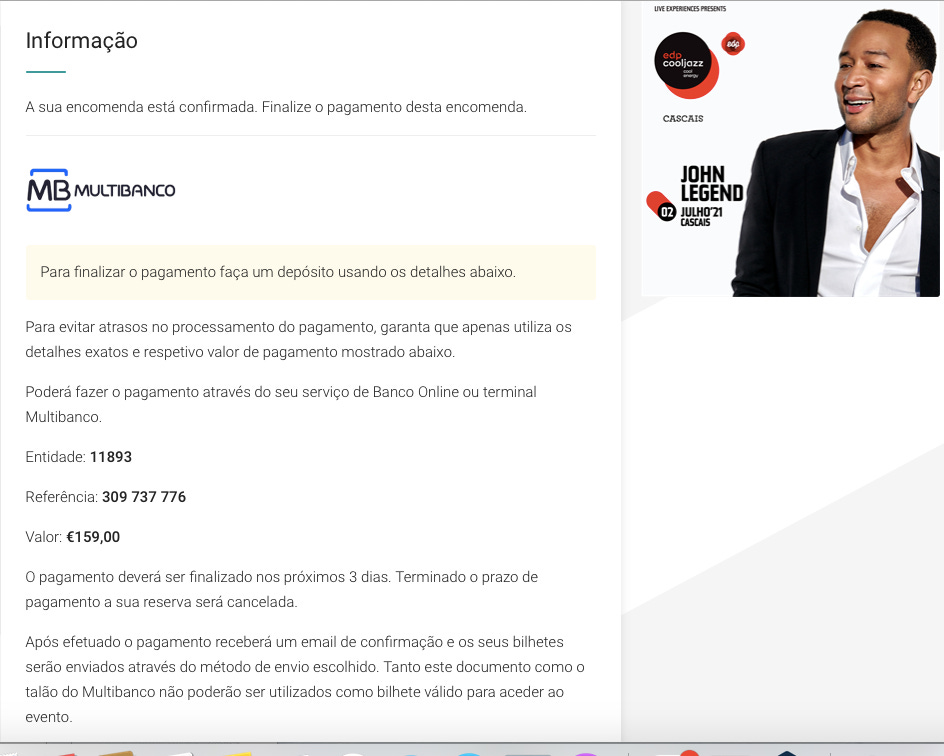

But it would appear there is a solution! A multibanco card, or the bank’s app, provides that solution. You see an instant transfer of money between financial institutions, what in the states I would have called a wire transfer, is common here. We have now made three online purchases. In addition to the Rad bike, we shopped at Ikea and purchased tickets to a John Legend concert in Cascais later this summer. They all operate the same way. As you checkout, you are provided the information needed to send money from your account to the vendor. In the screenprint above you see our purchase of concert tickets. In the case of Rad, we are transferring funds to another country so a bit more info is required.

IBAN number - the International Bank Account Number

Name of Entity being Paid

Reference Number - unique to that transaction

You simply enter the info into the bank’s app or stop by a local multibanco machine to authorize the payment. Each vendor seems to decide how long they will hold your order to confirm payment before canceling it. In the case of Ikea, I received a reminder text within an hour. The concert tickets asked for payment within 3 days. Rad gave us a week.

A Cash Economy

When we traveled in Thailand, we learned first hand about a cash economy. The only time we used a credit card was when we checked into a hotel. While in this part of Portugal, many stores and restaurants accept credit cards, it is clear that more of the economy operates on cash and debit transactions. Dave Ramsey would be happy.

I give you credit for patients. I don’t handle things the way I did when I was your age. My breathe app gets a lot of use.

I would call the experience a “goat rodeo”; however, I like Portugal’s banking prowess.... wish our banks were that sophisticated.